On Wednesday we wrote a bullish blog on VivoPower International PLC (VVPR) as the transaction with Energi Holdings appears to be gaining traction. VVPR updated the market yesterday, with the buyout offer increased to $180 million in enterprise value. The stock initially shot up to over $6.00, but then it was unfairly attacked by retail shorts who think they are smart but really just do poor research. We will detail here how they are wrong, how Energi is a real company and how they are messing with the wrong people. By the tone of our last blog, you can tell that we think there is something a little fishy going on here with respect to the Tembo transaction. But VVPR being fishy doesn't mean that the Energi offering is not legitimate. We think that it's about to tear shorts apart and that VVPR is intentionally behaving a little shady to goad shorts in order to trap them. If you like our picks you can follow this blog by clicking the follow button on the top of the left hand panel. We have 1033 followers on here as well as 122 followers on our Canadian blog. You can also follow us on X @StockTradePicks which has over 5,000 followers.

This is an example of the poor research we saw on X:

Just because this guy can't do proper research doesn't mean the company isn't real. He claims in his thread on X that he was short. Like any smart investor, we did our research on Energi. As a company based in the UAE and is relatively underground, it is hard to find proper information on it. Our first step was to do a whois look up on their website:

Two men named Mohammad Puri and Muhammad Waqas. Mr. Waqas appears to be an account manager for Energi's webmaster in Pakistan. He is no longer relevant to the analysis. However, Mr. Puri is the Founder and Director of Energi. Once you know this, it's quite easy to go down the rabbit hole of information on Energi.

Here is Mr. Puri's LinkedIn profile. He's not very active because he clearly doesn't care about social media or online presence. But the little bit we do know about him is important:

1. He founded Energi in 2014.

2. He was a commodity trader at Glencore.

3. He was educated at the London Metropolitan University

Energi is presented as a UAE company, and that is likely where the largest operations and offices are held. But Mr. Puri is British, started his business career in Britain and has two registered companies in West Yorkshire, Puri Limited and Energi Europe Limited. Energi is born out of the UK, like VVPR, and this is likely where the two companies became known to each other and friendly. A document filed with the British government on March 25 shows that "The company confirms that its intended future activities are lawful". This interview with Mr. Puri gives further insight into his origins as a business man, his goals in life and business philosophy. Obviously this interview is meant to be friendly, but it portrays someone who is doing business with integrity. This is an important point we will return to later on.

In addition to Mr. Puri, there are 89 employees of Energi listed on LinkedIn. Most of them are private profiles, but of the people who have public profiles, that includes Abdullah Puri, another long time member of the company who is likely a relative to Mohammad. There is a lady who is a hiring manager in Mozambique. Giving credence that they have growing operations there. An enthusiastic and detailed gentleman in the UAE, an experienced dry commodities trader, an HR executive in Pakistan, another HR leader in Pakistan who is actively recruiting. Among dozens of other people. But we think by now we made our point. Energi is a very real company that has existed for over 10 years in all of the countries it claims to have operations in and by all indications of the aggressive hiring, is quite successful. The claims made on its "AI generated website" appear to have complete merit.

Funny enough that Blaine Tarr couldn't find a registered business in the UAE, but we had no problem finding Energi's registered business in Switzerland, exactly matching the information on the company website. It wasn't particularly onerous research either. Writing out this paragraph took longer:

We have no problem with bearish research if it's good research. The stuff being pushed by shorts is worthless garbage about Energi using Shutterstock images on its website and then claiming the company is fake because they are too stupid or lazy to find all the easily verifiable information out there. It's clear that Energi Holdings has multiple different subsidiaries and goes by the name Energi Asia, Energi Resources etc. But shorts try to push these off as different companies. If it can be tied back to Mohammad Puri, it's part of the company that we are looking for.

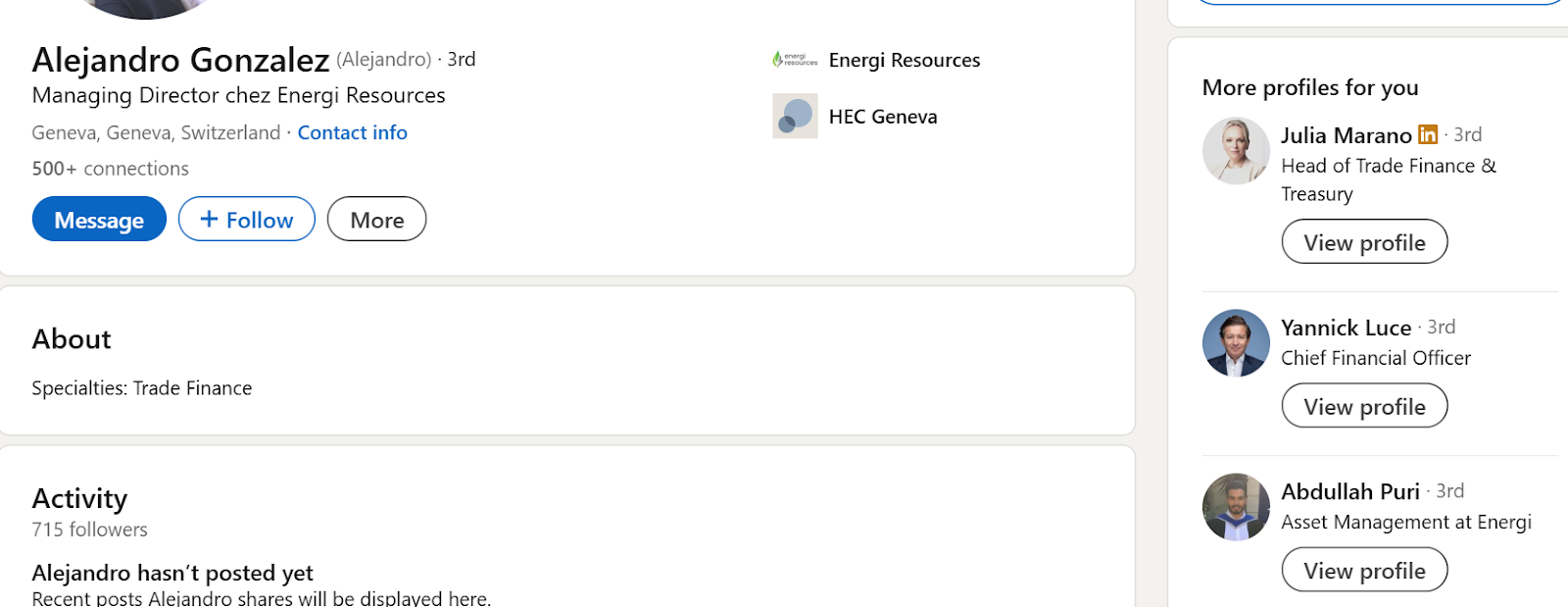

There is one more thing we would like to say about Energi Resources SA, though it's a bit of speculation on our part. There are two named members of management of this company, one of them being Alejandro Gonzalez.

This is his LinkedIn profile. Along with his roles at Energi, he used to work at GP Global Group. One thing we noticed on his profile are two profiles viewed most often along with his. Julia Marano and Yannick Lucce. Both high level employees in the finance division at Montfort. Mr. Lucce's hiring as CFO at Montfort was apparently a big enough event that Bloomberg dedicated an article about it.

Both of them work at Montfort, headquartered in Geneva. Montfort is a global commodity trading and asset investment company, with offices also located in the UAE. Montfort is the company that financed the purchase of Energi's operations in Mozambique. We speculate that Montfort is the entity behind financing the deal between Energi and VVPR. That's why the story can evolve from a $120 million payout to a $180 million payout. This is a rounding error to these people.

We are currently trying to dig up more information about this web of connections. We encourage other investors to look deeper into Mohammad Puri and Alejandro Gonzalez. Mr. Puri is the connection to the UK and likely knows the members of VVPR. Mr. Gonzalez is the connection to monied interests in Switzerland who have an interest in companies like VVPR. We suspect that either one of these two people are friends or associates of Kevin Chin, CEO of VVPR.

All this research up to now was to point out two things:

1. Energi Holdings and its various similarly named subsidiaries, led by Mohammad Puri, is a entity with substantial operations. It's 100% real, despite its barren website. The claims it makes on its website are easily verifiable by third party sources of data, including those registered with government agencies. Energi has a roster of employees on LinkedIn that is indicative of an international oil/energy and commodities trading business that is likely generating over a billion dollars in revenue.

2. Energi and Mr. Puri act with integrity. Look, it's an oil trading business. Obviously people in this business aren't saints. However, Mr. Puri legally registered his business in the UK and is subject to its laws. He just filed a form on March 25 with the British Government confirming that Energi's UK subsidiary's planned business activities are lawful. Energi and VivoPower aren't doing this to do an illegal pump and dump. There is no upside to it, especially not to Mr. Puri, to so clearly ruin his reputation. Up until now, few people outside of the oil trading industry and its employees ever heard of Energi. Now when you type Energi Holding into Google, the first thing that comes up is the deal with VivoPower. Do you think they want to turn this into an exposed pump and dump that caught thousands of angry retail shareholders who will call them scammers for the next 50 years? How is that strategy working for Trevor Milton or David Michery?

Energi MIGHT be acting as a front company for Montfort or someone else interested in VVPR's technology. Energi MIGHT be doing this as a personal favor to an old friend/associate, VVPR's CEO Kevin Chin. To get him out of this mess as VVPR has been an absolute disaster since it became a publicly listed company. Energi MIGHT be doing this as a way to increase publicity for itself or gain access to a NASDAQ-listed company for a future move to the exchange. But it IS NOT doing this to create a pump and dump scam.

Another X sleuth retail short posted this about Energi lending $600,000 to Cactus Acquisition Corp. 1 Limited (CCTSF), an illiquid SPAC valued at $56 million set to merge with Tembo. That particular short uses false equivalencies to claim that Energi is in on the scam. However, we use this loan as evidence that Energi is friends, associates, or otherwise interested in the success of VVPR, Tembo or Kevin Chin. The assumption that Energi lending money to facilitate the Cactus-Tembo deal as part of a scam does have merit on the surface...it's just wrong.

The big issue everyone has, including us, with the Tembo deal is how it is portrayed. It's portrayed as a deal that is valued at $838 million, or $904 million, depending on what press release you read about it. It is premised on the idea that CCTSF will issue 83.8 million shares at $10. CCTSF might have a stock price of over $11 right now, but it trades 300 shares a month. There is no liquidity or value in this shell. Anyone with half a brain and the littlest experience with the market knows that as soon as this deal would go through, CCTSF shares would tank from $11 to under $1.00, likely well under $1.00. The "$900 million" deal in practice would be worth $90 million or even $9 million in reality. There is no realism to this $904 million valuation...but it is technically accurate and legal to portray the deal this way. An investor or short may find Kevin Chin and the people associated with CCTSF to be shady when they portray the deal in this way. That's fine. But it is a complete false equivalency to lump in Energi and Mohammad Puri in with this scheme. All Energi did was lend money to keep Cactus functional. Energi wasn't involved in writing the press releases or determining the valuation.

While portraying Tembo as a nearly billion dollar deal is shady but still legal, there is no line of ambiguity here with the proposed Energi deal. It's still in the early stages and subject to due diligence, so there is still an out. But unlike with the loan, Energi and Mr. Puri have put themselves at the center of this deal. The $600,000 loan actually helps prove our case that Energi and VVPR are in some way friendly and will absolutely want to get this deal done. VVPR isn't just using Energi's name in these press releases without its knowledge or permission. Mr. Puri and his lawyers are just smart enough to know that a press release of this ilk must be written with reasonable clauses in it. With the Tembo deal, Kevin Chin's integrity might be on trial but Mohammad Puri's integrity isn't. However, this time around, Mohammad Puri's integrity IS on trial. That is the main difference here and that is why shorts are wrong to laugh off the deal the same way they laugh off the Tembo deal. We think VVPR may even be baiting the shorts who aren't smart enough to understand the difference between the Tembo and Energi deals and trap them in a squeeze. Judging by the opinions on X and other Fintwit spheres, it's working.

For all we know, the $120 million number could have been the "initial" number put out into the market, but the true "wink, wink" number was $180 million all along. Or maybe something even higher that will be disclosed down the road. We don't think Kevin Chin is such a brilliant negotiator that he managed to get Energi to increase the offer by 50% in the couple of days of "negotiations". Like we said, no issue with thinking something fishy is going on here, but that fishiness doesn't extend to the very existence of the deal itself. For all we know they just need to dot the i's and cross the t's but are using the wave of press releases and stretched out timelines to toy with market players, particularly shorts.

Energi is portrayed as a UAE-based company led by someone named Mohammad Puri (obviously of Middle Eastern descent). Some might compare this deal to some Chinese pump and dump where the perpetrators don't have any recourse in America as long as they don't commit fraud against the Chinese government or its citizens. The reality is Mohammad Puri is a UK citizen who registered a subsidiary of Energi in the UK and is currently putting out an offer on VivoPower, another UK registered company. If there is fraud here, it will be prosecuted to the fullest extent of British law. This isn't a deal created by entities and people in some far off land with no extradition treaties with countries in the west.

Energi is a real company. The deal with VVPR is a real offer presented with a CASH-based valuation of $180 million. The parties involved all appear to want to get this deal done. Since the deal was increased by $60 million from $120 million to $180 million, we need to increase our per share target by $7.85. Our initial estimated range of $9.16 to $15.70 is now increased to $17.00 to $23.50. As the stock price is around $4.00 now, we don't expect it to skyrocket to $17 overnight. But we do expect wild gyrations and trading opportunities, much like the one we saw on Thursday. Just don't be stupid enough to be caught short at the wrong time. The next pump could occur at any moment. We now know that the company likes to halt the stock for news during trading hours. It already happened twice. In order to provide us updates, or "updates" to this (already done?) deal. It feels like a wrestling script where the outcome is already known, but the plot is stretched out to get as many people as possible watching Wrestlemania.

Disclosure: We are long VVPR

No comments:

Post a Comment