Visionary Holdings Inc. (GV) is one of the most unusual stories we have ever come across. The stock has been on fire starting on March 5th when it announced that it received $1 billion in a financing consent letter from the Alfardan Group for the product research and development and global market development of PEGASUS new energy vehicles. The stock rose from $1.29 to trade as high as $9.60, before closing at $5.96 on Friday. While the stock has risen significantly, it is undervalued by many multiples compared to what this type of deal should entail. The market clearly is skeptical, though follow up releases makes it sound like the company is dead serious about this deal. If this is a real deal, GV will be a massive winner. If you like our picks you can follow this blog by clicking the follow button on the top of the left hand panel. We have 1033 followers on here as well as 122 followers on our Canadian blog. You can also follow us on X @StockTradePicks which has over 5,000 followers.

Since the release on March 5th, the company followed this up with an announcement of an order for 12,000 new energy vehicles in Hong Kong on March 7th. It explained the layout of the new energy vehicle ecosystem in a press release on March 10th. Outlined a roadmap for a battery swap rollout in Hong Kong in a press release on March 12th. This release outlined plans to build out 600 stations in Hong Kong by 2029, including 10 in 2025 with the first one to be launched this month. This initiative will cost approximately $55 million (translated from $420M HKD). Finally, on March 14th, GV announced that the $1 billion loan has been secured. The company said all the right things in the news release, with promises to be transparent about this deal and its corporate updates, and be in compliance with strict disclosure as a U.S.-listed company.

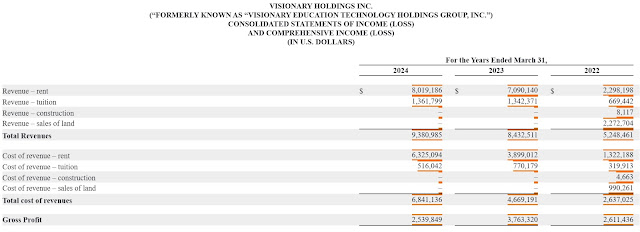

GV said a lot of the right things, because clearly the market has its doubts as this sudden change in business doesn't make a lot of sense. GV started out as an education company and has talked a lot about AI and health care in its business plans. But the truth is that the majority of its revenue comes from rental income (with some from tuition) while its profitability comes from the successful flipping of its various properties in and around Toronto, Canada. Here is a snapshot of its 2024 income statement ended March 31:

The company earned $0.32 EPS in fiscal 2024. Even after the recent run, that's a respectable 19 P/E multiple. Much like most of Canada, it lives and dies on the price of real estate rather than successfully building a business. However, that may be set to change. GV began its barrage of press releases about a month ago, after tariff talk between the United States and Canada really ramped up. Canadians have been looking to de-integrate their economy from the United States in response, particularly its auto sector which companies like Magna Group rely heavily upon U.S. business. A company like GV does have the connections to make international business happen. A loan from Qatar, a deal in Hong Kong, and leveraging Magna in Canada from a company led by Chinese-Canadians. This is the type of thing that makes sense in Canada right now.

Unlike most small caps, GV isn't some loser company with no connections. The company lists $83.5 million in property assets on its balance sheet. The bulk of that is presumably the book value of the various commercial properties it owns in and around Toronto. That doesn't include the properties that were successfully flipped in the past. So it's plausible that management has developed a trusted relationship with an investor like Alfardan Group which does have significant investments in real estate globally.

In addition to the unbelievable nature of the company's recent press releases, GV may also be held down due to some financing deals. The company issued a couple of loans that become convertible for shares starting in July. But the bigger is at the end of 2024, the company announced a Securities Purchase Agreement where 21 million shares would be issued at $1.00, for a total of $21 million. This would obviously result in significant dilution. However, that transaction was subject to regulatory approval and clearance and has not yet closed despite promises to by the end of Q1. There is a distinct possibility that the company won't bother to close this transaction given that it is in advanced stages of getting the $1 billion dollar loan. No need to dilute the shares that much under this new reality. If this is the case, anyone who is shorting the stock with the expectation of dilution from this share purchase agreement or others could be in for a shock. We can't discount the opportunity of a short squeeze as cost to borrow rates on the stock increase.

Assuming that all things progress as stated in GV's press releases, it is a company with a $23 million market cap that has:

1. Access to a $1 billion loan.

2. Involvement in the development of PEGASUS with an order for 12,000 vehicles in Hong Kong.

3. The build of 600 battery swap stations in Hong Kong.

4. The real estate and rental business in Toronto that generated a $0.32 EPS last year. That alone supports a $5.96 stock price. Though this business may be subject to wild swings in profits and losses year to year based on the commercial real estate business in Toronto.

5. Tuition income, plus whatever else it may dabble in other industries.

GV has 3.8 million shares outstanding. A stock price of $100 leads to a $380 million market cap. Considering the billion dollar loan and the order for 12,000 vehicles, this is a conservative enough valuation if you believe these deals will get done. Even if one doesn't believe that the deals will go through despite the company aggressively stating its intentions to succeed and be honest about it, the existing EPS of $0.32 and the threat of frequent press releases that consistently cause the stock price to spike gives traders likely multiple profitable exit opportunities at a $6.00 buy in point. Given the volatile nature of the stock and unusual situation but also massive upside, we recommend that investors be ready to flip the stock as buy low sell high trading opportunities of $2-$3 in daily variance exist nearly every day. But keep a small portion on the side tightly held for the lottery ticket upside.

Disclosure: We are long GV

No comments:

Post a Comment