Last month we posted on our Canadian blog about Sintana Energy Inc. (SEI.V) (SEUSF). After a few weeks of trading on the TSX Venture in the $0.25-$0.30 range, it has finally broken out to new 52-week highs this past week, closing at $0.33 CAD on Friday. We think this breakout is just the beginning as Sintana represents a unique ground floor opportunity to get into a pureplay on the Orange Basin in Namibia at less than $100 million market cap. What's more is that there is a cheap leveraged opportunity on in-the-money warrants which could move up 10 times if the stock price triples. If you like our picks you can follow this blog by clicking the follow button on the top of the left hand panel. We have 1018 followers on here as well as 119 followers on our Canadian blog. You can also follow us on Twitter @StockTradePicks which has over 5,000 followers.

Sintana has oil interests in Colombia, but by far the most prospective opportunity is its multiple onshore and offshore holdings in and around the Orange Basin in Namibia. Two multi-billion barrel discoveries were made last year in the basin, but it was the third discovery announced in March by state-owned NAMCOR and its partners Shell and QatarEnergy that appeared to be the catalyst for Sintana's recent rise in stock price as its potentially the biggest discovery to date.

Reviewing the company's corporate presentation, you get a good sense of where its interests lie relative to these three discoveries. Jonker-1X sits between Graff-1X and Venus-1X, even closer to PEL-83 and PEL-90:

Both are carried by larger players with drilling expected in 2023. However, given how Sintana reacted since the announcement of the Jonker-1X find, it doesn't even need news on its own interests to continue its run. Another discovery made in the region will almost certainly lift the stock price. This may be why the company is Tweeting out news about TotalEnergies SE (TTE) being days away from carrying out the first production test on Venus amid hints that the thickness of hydrocarbon pay zones may be bigger than revealed originally. This anticipation is what is causing Sintana's continued breakout. TTE has a $145 billion market cap. A major discovery well beyond initial expectations is only going to move the stock a few percentages points. A 10% move is $15 billion addition to the market cap. Sintana on the other hand could add $100 million in market cap as a neighboring interest and more than double its stock price.

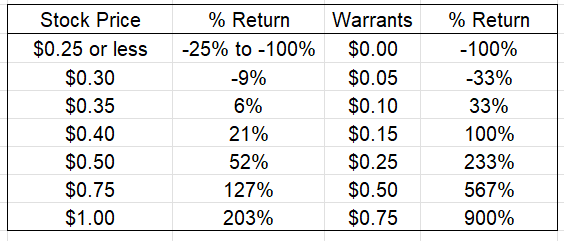

This is where the warrants come in. They have a strike price of $0.25 and expire next March. As the stock closed at $0.33 on Friday, they are worth $0.08 but last traded at $0.075, so there is no time value attached to them. This makes them extremely cheap upside leverage for anyone who is willing to tolerate a risk of a complete loss if the stock is $0.25 or less by March. This chart summarizes the opportunity:

If the stock drops to $0.25 or less by next March, the warrants are worthless. But if an owner of the warrants decides to sell their warrants before expiry, they are likely to recover something from them even if the stock price drops below $0.25. At $0.30, or a 9% loss on the stock, the warrants are worth $0.05, or a 33% loss. However, the stock only needs to rise 6% to $0.35 to have the warrants increase 33% in intrinsic value to $0.10. At $0.40, the value of the warrants doubles to $0.15. The leveraged upside becomes apparent until the stock triples to $1.00, where the warrants would be worth $0.75. A 900% increase or 10 times your money from $0.075. We think that these warrants are an absolute steal with no time value as news and hype around the Orange Basin isn't going to stop any time soon.

Edit August 1: Galp Energia, SGPS, S.A. (GLPEY) has identified large and high quality prospects on PEL 83. Sintana owns a 4.9% stake through its 49% ownership in Custos Energy. Once official news is released on this discovery, we expect Sintana to skyrocket.

Disclosure: We are long SEI.WT.

No comments:

Post a Comment