Last week, we announced a new top pick trading on the TSX Venture on our Canadian blog. Since then, Simply Better Brands Corp. (PKANF)(SBBC.V) has doubled from $0.25 to $0.50 CAD. We still think it has about 5 times the upside despite the heavy move so investors can feel confident that they are still buying low even if they missed the absolute bottom. We'll get into why in a bit. But first we would like to announce our new Canadian pick here, GobiMin Inc. (GMNFF) (GMN.V). While SBBC's valuation could be up to each individual's interpretation of the value of its revenues and heavy growth, there is no ambiguity with GMN. It's most definitely undervalued with more than a 100% upside after last week's transaction and we expect that gap to close soon. We are up to 1,000 followers despite not giving out a lot of alerts, a fact that we think is indicative of a successful, diligent and prudent stock picking history. If you like our picks you can follow our blog by clicking the follow button on the top of the left hand panel. You can also follow us on Twitter @StockTradePicks.

Last week GMN announced the following:

Toronto, Canada, July 14, 2022 (GLOBE NEWSWIRE) -- (TSXV: GMN) GobiMin Inc. (“GobiMin” or the “Company”, together with its subsidiaries collectively the “Group”) is pleased to announce that it has entered into a definitive agreement to sell the 100% indirect equity interest in a wholly-owned subsidiary, which owns the 70% indirect equity interest in the company holding the mining licence of the Sawayaerdun Gold Project, to a subsidiary of a Hong Kong listed mining company which is an independent third party to the Group (the “Buyer”) for approximately CAD95 million (USD74 million) in cash, which will result in net proceeds to the Company of approximately CAD88 million (USD68 million) after payment of Chinese taxes and transaction related expenses (the “Disposal”).

The Group shall receive from the Buyer the consideration, net of the withholding tax payable to China, after the registration of the equity transfer with the local authority and the completion of the handover. The Disposal is expected to be completed on or before September 30, 2022.

Mr Felipe Tan, president and Chief Executive Officer of GobiMin commented as follow: “the decision to sell the Gold Project has been arrived at a careful consideration of all options open to us under the current economic and market conditions. The Disposal enables the Group to maintain a strong financial position and the net proceeds from the Disposal can be used for pursuing new business opportunities.”

The Disposal is an arm’s length transaction as defined in the policies of the TSX Venture Exchange.

As of April 22, 2022, GMN had 49,194,982 shares outstanding, with no outstanding warrants or options - very unusual for a TSXV stock. That number is actually down to 49,183,982 as the company has bought back shares as part of a normal course issuer bid:

Under the Bid, a total of up to 2,459,749 common shares may be purchased through the facilities of the TSXV, representing 5% of the issued and outstanding common shares of the Company, and any such purchases will be at market prices. All common shares purchased pursuant to the Bid will be returned to treasury for cancellation. The Bid will commence on or after April 29, 2022 and will end on April 28, 2023 or on such earlier date as GobiMin may complete its purchases pursuant to the Bid or as it may otherwise determine. Purchases pursuant to the Bid will be conducted through Raymond James Ltd.

Seeing such a shareholder-friendly structure, tight float and buy back of shares is very unusual behavior for TSXV stocks. That's why we think this stock can go up to its fair value very quickly. The stock is thinly traded, but now management has free reign to buy up 2.4 million shares on the open market when it has taken only about 700,000 shares combined over the past three days to take it from $0.20 to $0.88 CAD from both the Venture and OTC listing volume.

What is that fair value? In addition to the $88 million in CAD after payment of taxes and transaction costs, the company has $19.6 million in cash and other short term assets against $2.8 million in liabilities for $16.8 million USD worth of liquid net assets as of March 31, 2022. Translated to CAD, that's over $21 million. The fair value is $109 million divided by shares outstanding or over $2.20 CAD.

The company has the ability to increase this per share value by buying back shares below this amount. Let's say it purchases 2 million shares at $1.25 per share. The share count reduces to 47.2 million while the net cash balance reduces to $106.5 million, resulting in a $2.25 per share value. GMN is a clear buy here at less than $1.00.

Next up, SBBC. Back in February, it announced a $2.5 million CAD private placement priced at $4.31. In May, it extinguished nearly $600,000 in debt for shares valued at $4.20 per share. Since then, all hell has broken loose as the stock tanked to as low as $0.17 before its run over the last several days to its $0.56 high set today thanks to a strong financial update:

"Strong Customer Acquisition and Expanded Distribution Footprint Raise Expected Annual Outlook to $50-$55 million and Positive Adjusted EBITDA

VANCOUVER, British Columbia, July 13, 2022 (GLOBE NEWSWIRE) -- Simply Better Brands Corp. ("SBBC" or the "Company") (TSX Venture: SBBC) (OTCQB: PKANF) is pleased to announce it is raising its 2022 financial outlook based on year-to-date results and business momentum. The sources of growth remain customer, category, channel and geographic expansion. All amounts are expressed in United States dollars unless otherwise noted. Certain metrics, including those expressed on an adjusted basis, are non-International Financial Reporting Standards ("IFRS") measures, see "Non-IFRS Measures" below.

Preliminary June 30, 2022 Quarter to Date and Year to Date Results

Preliminary sales for the quarter ending June 30, 2022, were $16.8 million compared to 3.1 million for the comparable period or a growth rate of 440%.

Preliminary gross margin for the six months ending June 30, 2022, was margin of 69% compared to 59% for the comparable period.

Preliminary sales for the six months ending June 30, 2022 were $28.9 million compared to $5.6 million for the comparable period or a growth rate of 417%.

Preliminary gross margin for the six months ending June 30, 2022, was margin of 67% compared to 61% for the comparable period.

The PureKana and TRUBAR brands both achieved positive adjusted EBITDA margin in the months of April and May. Full second quarter and six-month results are due to be reported on August 30, 2022.

2022 Outlook

As a result of the strong year to date and quarter to date preliminary results as of June 30, 2022, the Company's guidance is changing as follows:

Expected consolidated net sales are increased to $50 million-55 million from $40 million-$42 million.

Expected gross margin as a percentage of net sales is increased to 63%-65% from 58-60%.

The Company continues its expectation to achieve positive Adjusted EBITDA for fiscal 2022.

2022 Business Drivers

PureKana (purekana.com) customer acquisition model adding approximately 15,000 new customers per month driving year-to-date growth of 366%% vs. year ago or $22.7 million vs. $4.8 million. According to Brightfield Research Group mid-year 2022 report, this performance makes PureKana a Top 10 brand out of 4,000 brands in the category.

PureKana expansion of a national salesforce for brick and mortar retail with a differentiated and innovative portfolio.

TRUBAR’s (truwomen.com) expansion into Costco. By Q3 2022, TRUBAR has secured distribution into 50% of the U.S. based Costco regions with velocities exceeding bar category expectations.

No B.S. Skincare (livenobs.com) launch into 3,200 CVS stores for Back-to-School migrating to on-shelf presence in September 2022.

Planned geographic omni-channel expansion into the UK Market in the back half of 2022.

Company Updates

The Company is also providing the updates:

The Company is making progress in expanding its credit facilities with 2Shores Capital to support growth with its expanding Costco business.

The Company is holding its Annual General Meeting on July 29, 2022. These materials are available at: https://odysseytrust.com/client/simply/ OR www.sedar.com

The Company has agreed with CFH to pause work on the potential acquisition due to its current share price and is looking for other ways to achieve some of the benefits identified with this acquisition. These may include a supply arrangement and joint R&D work on new products.

"As our strong first half results illustrate, we are positioned for sustainable and positive adjusted EBITDA growth in 2022 driven by our PureKana, TRUBAR, and No B.S. Skincare brands. Our strategic growth priorities remain to lead consumer-centric innovation and relentlessly acquire customers to these emerging brands by driving customer, category, channel and geographic expansion. In parallel, we look forward to integrating the recently completed acquisitions of BRN/Seventh Sense and Hervé into three growth verticals: plant-based wellness, food and beverage, and health & beauty. Our model to acquire and build emerging brands in the clean ingredient space is working. We now have all three of the core brands in growth mode of both distribution and channel." says SBBC CEO, Kathy Casey."

The chart below summarizes the financials and 2022 guidance the best we could given the information we had, taking mid-point of guidance for the full year:

As good as these numbers are, it's clear that the company is still underestimating its expected full year performance. When we compare the first half of 2022 to the expected second half, revenue would have to decline nearly 20% and gross margin nearly 8 basis points to meet mid-point of guidance. But if we look at 2021 numbers, the company does not have unfavorable seasonality. Q4 2021 was its best quarter in terms of margin and revenue growth, which makes sense as it was a stepping stone for Q1 2022. In addition, the aggressive channel expansion as highlighted in the 2022 Business Drivers section all starts in the second half. Perhaps getting into Costco and CVS will result in some gross margin pressures as large chains tend to squeeze the margins of the upstart brands. But there is no way that revenue will come in lower for the second half. Assuming revenue is merely flat to Q2, second half revenue will come in at $34 million. That's $63 million in annual revenue for 2022, with it likely being higher than that.

Adjusted EBITDA for Q1 was negative $900,000. The company is forecasting positive adjusted EBITDA for the full year, so that means there must be at least $1 million in positive EBITDA for the remaining nine months of the year. This indicates that the gross margin improvement is flowing to the bottom line.

The company has 30.6 million shares outstanding, so a $0.25 stock price leads to a market cap of less than $8 million. The financials are in U.S. Dollars, so $63 million in annual revenue translates to about $82 million Canadian. At $0.50, SBBC is trading at less than 0.2x its revenue.

There are health and wellness and similar type of consumer goods companies that do trade at similar low revenue multiples. For instance, NewAge, Inc. (NBEV) trades at an enterprise value of approximately $64 million while having $440 million in trailing four quarters revenue as of Q3 2021. It also has gross margins in the 65-70% range. But there are mitigating factors for NBEV that is causing it to trade so cheaply. First, NBEV is delinquent in its financial filings. Second, after years of strong growth to the point of having a $440 million in annual revenue, it's still reporting negative EBITDA. At this time last year, it was trading at a $500 million enterprise value, or over 1x revenues.

Most of these type of healthy food, beverage and CBD-infused companies trade at a 1x to 1.5x revenue multiple. For instance, The Vita Coco Company, Inc. (COCO) - $650 million market cap - trades at about 1.6x revenues and The Alkaline Water Company Inc. (WTER) - $60 million market cap - trades at about 1x revenues. If SBBC was to trade at 1x its revenues, the stock price would be over $2.50, or a 5x upside from here. This would still be below the stock price that debtholders decided to accept shares for debt and merely be returning to the price levels seen as recently as late May.

A stock doesn't decline over 90% in two months because of a bear market. There is clearly some manipulation here and likely financial players are shorting the stock in order to try to force the company to do a financing at a low price. The short interest is not large at less than 200,000 shares as of June 30th. But for a company that seldom trades 200,000 shares in a day until recently, that's actually pretty significant. The short interest increased 160,000 shares between June 15 and June 30, so most of the short interest occurred sub-$0.50, clearly an attempt to force the company into a tight spot. Given the recent rise in stock price, shorts may have been forced to cover or are going to do so soon as their position has turned from green to red.

With the increased guidance, the chances of the company needing cash to survive has decreased. Yes it's a startup and could always use more cash, but it's a startup in a surprisingly good shape from a cash flow perspective. Have a look at the Q1 cash flow statement:

Despite the $3.3 million net loss and negative EBITDA, SBBC generated positive cash flow from operations of $500,000. The two major drivers in favor of the variance between cash flow and net income numbers are deferred revenue of $1.7 million and share-based payments of $1.1 million. Employees are willing to take share based comp in lieu of cash payments for their services. This is par for the course for most young companies. But the deferred revenue is unique. SBBC is getting upfront payments for revenue that will be earned in future quarters. As revenue growth remains strong, we can assume that this trend will only get bigger with time. Instead of using dilutive equity issuances, the company is taking advantage of friendly payment terms where cash is being received before product is being shipped and may have the option of using purchase order financing. Deferred revenue figures could likely surpass $5 million in upcoming quarters as revenue figures grow. This creates a liability until the company earns this revenue, but this also greatly strengthens its cash position in the near-term, which is exactly what this company needs to avoid dilution at sub-$1.00.

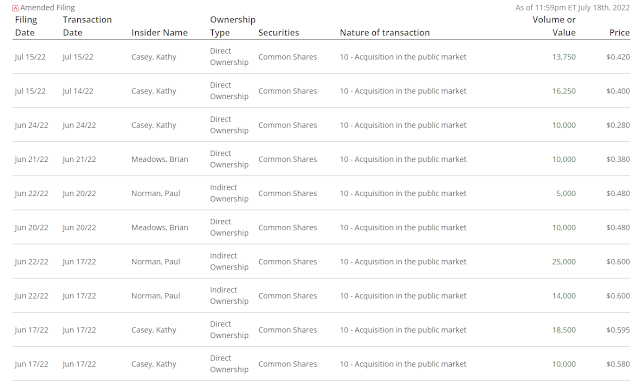

The strong financial position relative to stock performance is also highlighted by insiders relentless buying of shares no matter the price:

Over the past month, insiders have purchased a total of 132,500 shares at price ranges varying from $0.28 to $0.60. That's why investors who missed out on the bottom or our original call at $0.25 shouldn't feel too bad - insiders certainly feel all of these price levels are cheap.

This buying has been led by CEO Kathy Casey, with her purchase history according to SEDI listed below:

Ms. Casey started off with 47,292 shares as of June 14th. She has since increased her share ownership by 315,000 to 357,292, all with open market purchases over the past five weeks. This $139,000 worth of buying came in at an average cost of $0.44 CAD. This is a major amount of buying for a CEO of a small cap company to undertake in such a short amount of time. This should give investors who are buying in around $0.50 piece of mind. They are buying at just above the CEO's buy-in point, a CEO who has given no indication that she will stop buying any time soon.

In addition to her heavy buying, she also has 532,000 stock options at a price of $5.70 USD. It goes without saying that those options are completely worthless without a greater than 10x rise from here.

The combination of a lack of a need to dilute, exhaustion of sellers (either retail traders dumping at a loss or initial investors selling after the lock on their shares expired), heavy insider buying and incentives for shorts to cover their position leads to one conclusion. Expect a violent increase in stock price at any time. The financials justify it.

Disclosure: We are long SBBC.V, GMN.V

No comments:

Post a Comment