APOP Price Target: $20

APOPW Price Target: $12.50

On March 16th, we called a buy on Cellect Biotechnology Ltd. (APOP) and recommended that people sell their position on Catalyst Biosciences (CBIO) after it finally achieved the heavy spike we had expected on February 13th in our article "The Next Reverse Split-Fueled Runner". Just prior to that call, we called KBS Fashion (KBSF), "KBSF: Undervalued Microcap Set For Post-RS Run Like DRYS, ETRM or IPDN" on February 9th and KBSF rose from a split-adjusted stock price of around $3 to as high as $18 in the following days. Note the timestamp of 8:35 AM U.S. Pacific Time or 11:35 New York time on the March 16th article. APOP was trading around the mid-$8's at that time and CBIO at $15 or $16. For a while on Wednesday morning the calls went against us, but by the end of the day APOP finished strong at $8.74 and CBIO sunk to $10.51.

We had seen what had happened to stocks like DryShips Inc. (DRYS), EnteroMedics Inc. (ETRM), Interpace Diagnostics Group, Inc. (IDXG), Real Goods Solar, Inc. (RGSE), Globus Maritime Limited (GLBS) and SAExploration Holdings, Inc. (SAEX) after their reverse splits in late 2016. So that's why we recommended KBSF and CBIO. Unlike KBSF, CBIO doesn't have the financial performance to support a strong stock price. We think that now that it has had its big move, a financing will come. We don't mean to trash the stock, but looking at DRYS, RGSE, ETRM, IDXG and many others, traders can see that all of those stocks fell mightily after their big spikes. KBSF has also pulled back significantly, but it's different in that it has over $14 per share in cash. It can fundamentally support a stronger stock price. Read our other articles on KBSF if you want to learn more.

If you like our picks make sure to follow our blog by clicking the follow button on the top of the left hand panel. We are up to 138 followers. At the time of the KBSF article on February 9th we had 83 followers. We have only released 6 blog posts on 3 different stocks (KBSF, CBIO and APOP) since that time. So our strong growth in followers despite not many posts should be indicative of the quality that people feel they are getting from reading our research. If you follow, you should get an alert on Google+ when we have a new report up (when you use Chrome). So keep your eyes peeled. We don't post a lot because we want to be 100% sure about our picks. There is no doubt a lot of crap in the small cap world on the NASDAQ that we have to skip over.

To understand why we like APOP so much, read the excellent news that the company released on March 27 regarding its successful first cancer patient stem cell transplant for its Phase I/II clinical trial using its ApoGraft™ technology.

Someone might think, well what's the big deal? Biotech companies start recruiting people for Phase I/II studies all the time. Understand that this is a stem cell transplant. Biotechs testing out drugs have to pass certain safety standards before they can start giving their drugs to people. But as far as the actual administration, it's as simple as swallowing a pill. The proof of efficacy doesn't come until the end of the study. APOP on the other hand is performing the following with ApoGraft:

"All of our research efforts to date have culminated in clinical trials that we plan to commence in the third quarter of 2016 related to a process we call ApoGraft. The ApoGraft process begins with the donor’s white blood cells being collected into a standard infusion bag using specialized equipment in a process called cell apheresis. The collected cells (the untreated sample - ‘standard of care’) undergo quality control tests, and upon confirmation of their quality, are then washed in an incubation medium and centrifuged. The white blood cells are counted and resuspended in the incubation medium in the appropriate concentration. These cells are introduced with FaSL and incubated. Following incubation, the cells are again centrifuged and washed and subsequently resuspended in Plasma-Lyte added with 5% Human Serum Albumin (HSA) or equivalent. A few cell samples are then taken for a second quality control test that includes sub-population characterization in the same manner as described above. The graft that contains stem and progenitor cells and graft-supporting T-cells is transfused to the patient within approximately 4 hours via filter."

The fact that the patient isn't already very sick from this transplant is an encouraging sign. Now it's just a matter of waiting to see if the patient remains in good health. From clinicaltrials.gov, we can see Cellect Biotechnology's study parameters under the trial record NCT02828878:

We see that the primary endpoint measure is the number of adverse effects on a patient in the first 100 days. Now the study is meant to be complete by September 2018, but data is expected before then and we know that the clock has already begun ticking on the first patient. So the stock could move well before then if stories of a "miracle process" get out.

Shorts are resorting to desperate lies - Could a short squeeze be coming?

There's nothing more telling about how desperate shorts are when they inundate social media sites with falsehoods. This short has nearly 30,000 followers on StockTwits and has led those followers down a wrong path based on this lie:

The claim that APOP hasn't made a dime in 15 years is completely inaccurate. Last year's F-1 statement confirms that Cellect Biotherapeutics was incorporated in Israel in 2011. Dr. Shai Yarkoni co-founded the company in 2011 and became its CEO in 2013 according to Bloomberg. So how can the company have not made a dime in the past 15 years when it has only been around for six? The CEO made mention of the drug being in development for 15 years, but anyone with any experience trading biotech companies knows that there is no expectation of revenue during the development stage, especially for stem cell research. The stock listing on Tel Aviv existed prior to Cellect but if the company got listed through an RTO whatever the previous company did that owned the stock symbol has no relevance to today.

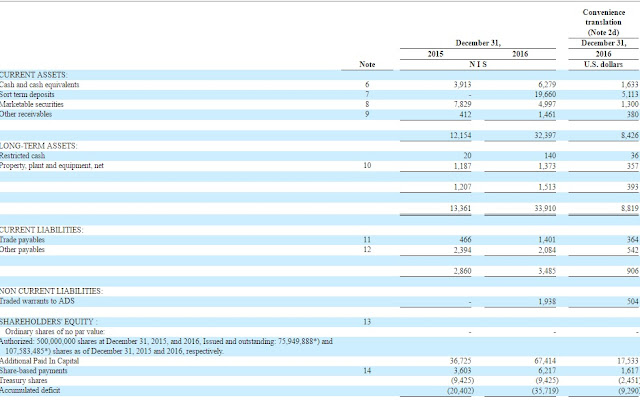

Look at the balance sheet with the first two columns in Israeli Shekels and the final column translated to U.S. Dollars:

APOP is well cashed up with about $8 million U.S. in working capital. Take a look at the accumulated deficit. It's only $9.3 million even as the company has managed to get so far as being able to do stem cell transplants. This is very cheap by anyone's standard. The fact that someone is trying to point out that it hasn't made a dime in 15 years is intellectually dishonest. Shorts or potential shorts have been misled and now may have to cover on a very small float stock.

According to Yahoo, APOP's float is only 3.14 million shares. The short interest as of March 15 is only 42.7K shares but that came before the big spike on Monday which has no doubt collected more shorts. In a few days we will know the short interest for the end of the month. We can expect a squeeze at any time especially since we know that there is little near-term threat for financing.

Target: $20 on APOP, $12.50 on APOPW

There are 107 million shares outstanding on the Tel Aviv exchange. The ratio of shares to ADS on the NASDAQ is 20, meaning that there is about 5.4 million ADS outstanding on APOP on the NASDAQ listing. We can round that up to an equivalent of 6 million to account for existing and recently granted options.

As part of the financing and listing completed last July, 969,231 warrants with an exercise price of $7.50 and a term of 5 years started trading under the symbol APOPW. With an expiry date in 2021 these warrants are a great opportunity to buy into the company with leveraged upside. At $8.74, the stock price offers 129% upside to $20. At a closing price of $2.30, APOPW offers 443% upside because the warrants would be worth an intrinsic value of $12.50 - $20 on APOP less the $7.50 strike price of the warrants.

The warrants are under no threat of being exercised because they are publicly traded with so much time left to expiry. It makes more sense for warrant owners to sell them than to exercise them and will remain so until 2021 when there is little to no time value left. Including the warrants there are about 7 million fully diluted ADS shares outstanding. A $20 target leads to about a $140 million fully diluted market cap which we find a fair comparison versus other early stage biotechs in the $100-$200 million market cap range.

While our target is $20, we are not seers nor the gospel. The stock price could top out at $12, $20 or $50 for all we know. We recommend that if traders find themselves to be substantially in the money that they ease out of a trade with profits. For instance, if you bought 10,000 shares at $9, you can begin selling at random prices - say, 1,000 shares at $12.32, another 1,000 at $13.68, another 1,000 at $15.07 etc. Choose random numbers instead of $12, $13, $14 etc to avoid building sell walls at certain prices. KBSF ran from $3 to $18 with our target being $30. Imagine how foolish it would have been to have not sold a single share and watch is pull back to as low as $5. New traders tend to want to do an all-or-nothing scenario where they buy all their shares and sell all their shares in one shot. You will never win trading like that. You will do much better easing in and easing out of trades.

Disclosure: We are long Cellect Biotechnology

If you are interested in penny stock picks, check out Microcap Millionaires.

APOPW Price Target: $12.50

On March 16th, we called a buy on Cellect Biotechnology Ltd. (APOP) and recommended that people sell their position on Catalyst Biosciences (CBIO) after it finally achieved the heavy spike we had expected on February 13th in our article "The Next Reverse Split-Fueled Runner". Just prior to that call, we called KBS Fashion (KBSF), "KBSF: Undervalued Microcap Set For Post-RS Run Like DRYS, ETRM or IPDN" on February 9th and KBSF rose from a split-adjusted stock price of around $3 to as high as $18 in the following days. Note the timestamp of 8:35 AM U.S. Pacific Time or 11:35 New York time on the March 16th article. APOP was trading around the mid-$8's at that time and CBIO at $15 or $16. For a while on Wednesday morning the calls went against us, but by the end of the day APOP finished strong at $8.74 and CBIO sunk to $10.51.

If you like our picks make sure to follow our blog by clicking the follow button on the top of the left hand panel. We are up to 138 followers. At the time of the KBSF article on February 9th we had 83 followers. We have only released 6 blog posts on 3 different stocks (KBSF, CBIO and APOP) since that time. So our strong growth in followers despite not many posts should be indicative of the quality that people feel they are getting from reading our research. If you follow, you should get an alert on Google+ when we have a new report up (when you use Chrome). So keep your eyes peeled. We don't post a lot because we want to be 100% sure about our picks. There is no doubt a lot of crap in the small cap world on the NASDAQ that we have to skip over.

To understand why we like APOP so much, read the excellent news that the company released on March 27 regarding its successful first cancer patient stem cell transplant for its Phase I/II clinical trial using its ApoGraft™ technology.

Someone might think, well what's the big deal? Biotech companies start recruiting people for Phase I/II studies all the time. Understand that this is a stem cell transplant. Biotechs testing out drugs have to pass certain safety standards before they can start giving their drugs to people. But as far as the actual administration, it's as simple as swallowing a pill. The proof of efficacy doesn't come until the end of the study. APOP on the other hand is performing the following with ApoGraft:

"All of our research efforts to date have culminated in clinical trials that we plan to commence in the third quarter of 2016 related to a process we call ApoGraft. The ApoGraft process begins with the donor’s white blood cells being collected into a standard infusion bag using specialized equipment in a process called cell apheresis. The collected cells (the untreated sample - ‘standard of care’) undergo quality control tests, and upon confirmation of their quality, are then washed in an incubation medium and centrifuged. The white blood cells are counted and resuspended in the incubation medium in the appropriate concentration. These cells are introduced with FaSL and incubated. Following incubation, the cells are again centrifuged and washed and subsequently resuspended in Plasma-Lyte added with 5% Human Serum Albumin (HSA) or equivalent. A few cell samples are then taken for a second quality control test that includes sub-population characterization in the same manner as described above. The graft that contains stem and progenitor cells and graft-supporting T-cells is transfused to the patient within approximately 4 hours via filter."

The fact that the patient isn't already very sick from this transplant is an encouraging sign. Now it's just a matter of waiting to see if the patient remains in good health. From clinicaltrials.gov, we can see Cellect Biotechnology's study parameters under the trial record NCT02828878:

We see that the primary endpoint measure is the number of adverse effects on a patient in the first 100 days. Now the study is meant to be complete by September 2018, but data is expected before then and we know that the clock has already begun ticking on the first patient. So the stock could move well before then if stories of a "miracle process" get out.

Shorts are resorting to desperate lies - Could a short squeeze be coming?

There's nothing more telling about how desperate shorts are when they inundate social media sites with falsehoods. This short has nearly 30,000 followers on StockTwits and has led those followers down a wrong path based on this lie:

The claim that APOP hasn't made a dime in 15 years is completely inaccurate. Last year's F-1 statement confirms that Cellect Biotherapeutics was incorporated in Israel in 2011. Dr. Shai Yarkoni co-founded the company in 2011 and became its CEO in 2013 according to Bloomberg. So how can the company have not made a dime in the past 15 years when it has only been around for six? The CEO made mention of the drug being in development for 15 years, but anyone with any experience trading biotech companies knows that there is no expectation of revenue during the development stage, especially for stem cell research. The stock listing on Tel Aviv existed prior to Cellect but if the company got listed through an RTO whatever the previous company did that owned the stock symbol has no relevance to today.

Look at the balance sheet with the first two columns in Israeli Shekels and the final column translated to U.S. Dollars:

APOP is well cashed up with about $8 million U.S. in working capital. Take a look at the accumulated deficit. It's only $9.3 million even as the company has managed to get so far as being able to do stem cell transplants. This is very cheap by anyone's standard. The fact that someone is trying to point out that it hasn't made a dime in 15 years is intellectually dishonest. Shorts or potential shorts have been misled and now may have to cover on a very small float stock.

According to Yahoo, APOP's float is only 3.14 million shares. The short interest as of March 15 is only 42.7K shares but that came before the big spike on Monday which has no doubt collected more shorts. In a few days we will know the short interest for the end of the month. We can expect a squeeze at any time especially since we know that there is little near-term threat for financing.

Target: $20 on APOP, $12.50 on APOPW

There are 107 million shares outstanding on the Tel Aviv exchange. The ratio of shares to ADS on the NASDAQ is 20, meaning that there is about 5.4 million ADS outstanding on APOP on the NASDAQ listing. We can round that up to an equivalent of 6 million to account for existing and recently granted options.

As part of the financing and listing completed last July, 969,231 warrants with an exercise price of $7.50 and a term of 5 years started trading under the symbol APOPW. With an expiry date in 2021 these warrants are a great opportunity to buy into the company with leveraged upside. At $8.74, the stock price offers 129% upside to $20. At a closing price of $2.30, APOPW offers 443% upside because the warrants would be worth an intrinsic value of $12.50 - $20 on APOP less the $7.50 strike price of the warrants.

The warrants are under no threat of being exercised because they are publicly traded with so much time left to expiry. It makes more sense for warrant owners to sell them than to exercise them and will remain so until 2021 when there is little to no time value left. Including the warrants there are about 7 million fully diluted ADS shares outstanding. A $20 target leads to about a $140 million fully diluted market cap which we find a fair comparison versus other early stage biotechs in the $100-$200 million market cap range.

While our target is $20, we are not seers nor the gospel. The stock price could top out at $12, $20 or $50 for all we know. We recommend that if traders find themselves to be substantially in the money that they ease out of a trade with profits. For instance, if you bought 10,000 shares at $9, you can begin selling at random prices - say, 1,000 shares at $12.32, another 1,000 at $13.68, another 1,000 at $15.07 etc. Choose random numbers instead of $12, $13, $14 etc to avoid building sell walls at certain prices. KBSF ran from $3 to $18 with our target being $30. Imagine how foolish it would have been to have not sold a single share and watch is pull back to as low as $5. New traders tend to want to do an all-or-nothing scenario where they buy all their shares and sell all their shares in one shot. You will never win trading like that. You will do much better easing in and easing out of trades.

Disclosure: We are long Cellect Biotechnology

If you are interested in penny stock picks, check out Microcap Millionaires.

If you're interested in trading options, both, calls and puts on some large cap stocks, check out binaryoptionsprosignals.com.

Learn to trade stocks, options, commodities and forex Profitably with Trader Review.

If you are interested in dividend stocks and return analysis, Then dividendstocksonline.com or Dividend Stocks Rock are for you.

If you're interested in gold, this WSW special report or the Goldmasterinvesting.com Ocean Of Gold Report are for you.

No comments:

Post a Comment