Edit 4/13: This morning the stock price fell to less than $11.00 in pre-market activity. SCLX has since returned to the $14's within the first 10 minutes of regular hour trading, indicating desperation tactics by shorts that are failing. In our opinion, we are on the brink of that squeeze.

On Friday, we published a bullish report on Scilex Holding Company (SCLX) called "SCLX Might be the Short Squeeze Meme Traders Have Been Waiting For". Since then the stock has continued to steadily rise, closing at $14.80 today. This is despite an S-1 filing for the release of 3.3 million shares for an $8.00 convertible debenture. We think this activity is getting the stock one step closer to the short squeeze that meme traders and other supporters of the stock are looking for as we close in on the April 17th Annual Meeting of Stockholders. If you like our picks you can follow this blog by clicking the follow button on the top of the left hand panel. We have 1019 followers on here as well as 120 followers on our Canadian blog. You can also follow us on Twitter @StockTradePicks which has over 5,000 followers.

Before getting into our update, first we will repeat the short squeeze theory. SCLX was a spinout of Sorrento Therapeutics, Inc. (SRNEQ), a polarizing and heavily-shorted company that has had many ups and downs through its trading history. Sorrento somewhat voluntarily went through the bankruptcy process post-spinout, presumably in an attempt to get a court-order account of the shares in SCLX. It might be working. This article provides a brief history of the situation between SRNEQ and SCLX, as well as the theory behind the short squeeze. While SCLX's float on Yahoo Finance is reported to be 85 million, that actually isn't true. The vast majority of these shares are locked up until May 11, with the actual float being in the two million range. There is another six million or so warrants (SCLXW) with a strike price of $11.50, but over a million of those have been purchased by Sorrento on the open market.

At the time of the spinout, there were around 60 million shares short of SRNE. This translated to 8.5 million SCLX shares short, all of which have the same lockup restrictions as the long shares, except that cost to borrow and margin requirements still apply. There aren't enough shares and warrants currently in the market to allow shorts to hedge. If brokers force the closure and margin calls of these positions before the May 11th hold period expires, the owners of the tradeable stock and warrants hold all the cards. They can set the price at which they want to sell. This of course only applies to reported shorts. It doesn't account for naked shorts, which if you believe the meme stock narrative, would be multiples higher of reported short interest.

Sorrento and Scilex are working hard to account for and stimulate the need to close off the short positions. As part of the bankruptcy proceedings, the companies got a court order for the top 25 brokers in the United States to provide a full ownership report of SCLX shares to Sorrento. Out of the 76 million shares issues, so far 44 million have not been reported. SCLX delayed its AGM from April 6th to 17th in order to give time for the brokers to account for the discrepancy.

One blogger speculates that this has been an intricate plan by Sorrento to force the covering of shorts. Sorrento having purchased some SCLXW warrants on the open market in addition to the massive SCLX holding it has could be a sign that the company is trying to profit from a short squeeze as well as exacerbate the situation for the shorts by reducing the availability of SCLX securities on the open market.

The preliminary S-1 filed after hours on April 10th involves the release of 3.3 million shares upon conversion of a $25 million debenture at $8.00. This would alleviate, but not completely eliminate, the problem for the unreported naked shorts. This is an opportunity for the debenture holder like it is for anyone who holds free trading stock. They are not required to convert the debentures into stock immediately and the longer they wait, the more interest they collect (which can also be converted into more stock). Bears on the stock were immediately shouting from the rooftops about this filing and coming dilution, and the stock did drop 8% from $14.15 to $13.00 the next day. But that drop was short lived as it was followed up with a 14% rise to $14.80 today. No doubt that this is continued covering or hedging by shorts, as well as opening of long positions by people who believe in this massive short squeeze opportunity.

The $14.80 price seen today is the highest the stock has closed. Not only is that a bullish sign in terms of technical trading, it also means the mark-to-market price that helps to determine margin requirements on short positions is higher than it has ever been. No matter what happens on May 11th when the lock comes off the distributed shares, or with the debentures, or the long term success of the company, the only thing that is relevant from a broker's risk management and credit department is the value of the short position today. Not what it might be 28 days from now. Those 8.5 million shares short are now marked at a combined $125 million. When the stock was trading at $12.90 last week, those short positions were marked at $109 million. Keep in mind this short position was created out of a 60 million SRNE short position which at $1.83 on November 11 was worth $110 million. Now the spinout shares are getting marked at a higher value all by themselves, exclusive of the market value of the SRNEQ short position. It's not hard to calculate what the combined mark-to-market value of these short positions would be at $20 or $50 or $100 stock price.

Meme traders should be able to smell the blood in this situation. The short position is getting more expensive to handle, and there is a larger short position than available float. Another clue to look at is the price of the warrants, SCLXW, relative to the stock. The warrants have a strike price of $11.50. Therefore they should trade at $11.50 less than the stock price, plus some time premium just like all options do. The warrants have generally traded with at least a $1.00 time premium. For instance, when the stock closed at $13.00 yesterday, the warrants closed at $3.10. $13.00 less $11.50 would lead to a $1.50 intrinsic value with the remaining $1.60 being attributed to time value. Today the warrants closed at $3.51 with the stock closing at $14.80, or $3.30 above the $11.50 strike price. That time premium has been almost completely eroded to $0.21. What does this mean? Shorts are losing control of the stock price.

Think of every single SPAC that went absolutely haywire. Whether a very popular and liquid one like DWAC or a more obscure recent example like LUNR. When they raced to close to $100, the warrants were actually worth a lot less than their intrinsic value. DWACW was something like $50 or $60 while LUNRW topped out in the $2's. Even call options on these types of SPAC runners would trade with very little time value. People would try to take advantage of the "arbitrage" by going long warrants and writing call options and they would get assigned from the calls right away, forcing an open short position that they would have to cover or pay high CTB rate. Here's an article from 2020 explaining the scenario on NKLA back when it was a recent de-SPAC. Reading the comment section you will get the point of the weakness of this "arbitrage" play and why it actually stimulates a further short squeeze at the expense of someone who tried to do some creative but short sighted financial engineering:

Unlike those other SPACs at the time of their big moves, SCLXW is exercisable so it won't ever trade far below its intrinsic value like LUNRW did. But it might trade a few percent below it for two reasons. First, SCLXW is less liquid than SCLX*, so there could be a point in time where the stock shoots up $0.50 but the warrants don't immediately follow simply for the fact that no bids or asks exist at that price. The second reason gets more to the point of shorter desperation, similar to the SPAC shorts and assigned call options mentioned above, except in reverse because these warrants are exercisable. SCLXW would trade less than their intrinsic value to entice warrant holders to exercise them rather than sell them on the open market and trade them back and forth between other bullish warrant holders like ourselves. Exercising the warrants increases the float of SCLX, which is exactly what SCLX shorts want in order to alleviate a further squeeze. If SCLX gets to the point where SCLXW is trading at a greater variance than $11.50, the shorts are losing control of the situation. Yes they can buy the warrants to try to hedge their shorts and cap their margin requirements to the $11.50 strike price (plus cost of warrants), but if margin requirements put so much stress on a short's account that their broker doesn't allow financial engineering, it's near the breaking point. The position would need to be covered or hedged directly with stock, not with warrants.

*The point about SCLXW being less liquid than SCLX is kind of funny given that there are actually three times MORE warrants than stock out in the open float right now. Common sense should be that warrants in the $3's with three times more float would trade with tighter spreads and with more volume than the stock in the $14's, but they don't. If there was ever any evidence of naked shorts rampant in the market, we would think this would be a clear example of it.

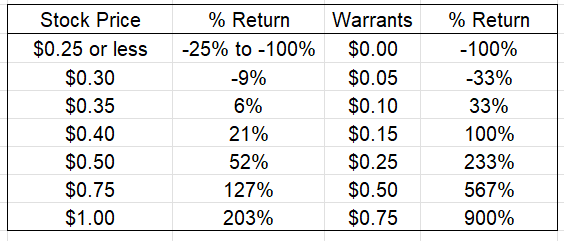

We have bought the SCLXW warrants. Why the warrants? Simple, a bullish bet with the maximum upside potential. If the stock goes to $20 - a 35% increase from $14.80 - the warrants are worth at least $8.50 - a 142% increase from $3.51.

Disclosure: We are long SCLXW